6 Things to Consider for Buying Your First Property

Striving to secure a roof on top of our head is in our blood but our capabilities don’t always agree with our instincts. We often hear someone break their bank to get the house of their dream but the dream immediately shattered as they fail to understand the perks and pitfalls of the Malaysia real estate scene. Fear not, as here are some of the wallet-friendly tips that will get you closer to your very first property purchase.

1. Define Your Goals

What is the purpose of your home buying journey?

• Live there: This is an ideal option that requires the least hassle. You will be looking for a home to suit your personal needs. But keep in mind that you might want to rent it out in the future.

• Rent it out: Malaysian property is perfect for landlords. Rental yields in the cities like Kuala Lumpur, Penang, and Johor Bahru soar through the roof.

• Flip it: Buying it cheap and selling it for a fortune is often done by property investor but bare in mind you will need to have the holding power to achieve your desired outcome.

2. Choose the Property Type

Understand the types of properties that suit your needs.

• Apartment and Condominium (highrise)

• Townhouse (a tall, narrow, traditional row house, generally having three or more floors)

• Semi-Detached house (build side by side with another house)

• Bungalow (usually deemed as luxury house with broad front porch)

• Terrace house (built in a row and connected to each other)

• Shophouse (row of terrace houses with ground floors used as shops)

One thing that is amazing in the real estate scene in Malaysia is that when it comes to the property types, you almost always get what you want regardless what you choose. Back to your goals, your goals basically will help you define the property type that best fit you. For example, serviced apartments and condominiums are most likely to achieve investment purpose as opposed to landed properties.

3. Location, location, location

Even if you are offered a great deal on a beautiful home, the first thing you need to do is look at the neighborhood. Pay close attention to the landscaping. If it appears neat and cared for, it means the local neighborhood council is doing its best to care for the area.

The neighborhood might seem perfect but is there plenty of vacant land around your house of choice? It might look perfect now since there are no neighbors to bother you, but what it really means is that you’ll soon have a construction site surround your home. And you can’t be sure that skyscraper won’t soon block the daylight from your windows.

4. Is There a High-Performing School Nearby?

A good school in the neighborhood will significantly pump up the value of your property. People with school-aged children are ready to pay extra to live near a school and if you are one of the many parents, you might consider buying one for your own stay.

5. Who is The Developer?

If you think you’ve found the perfect property, you must do your developer research. Each reputable developer will have his own website where you can see the completed projects. Go further to ask people living in such houses for their feedback. Don’t ever go for a cat in a bag. You risk having problems with the quality of the house.

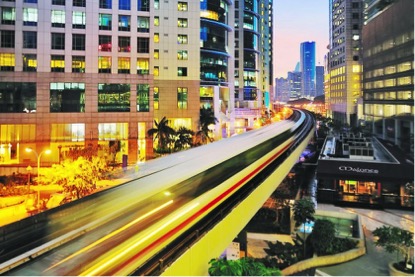

6. Connectivity

The most recent hype in Klang Valley will be the construction of the many MRT stations. Having MRT station nearby means a higher chance for a surge in property prices and so will the renting yields.

The same rule applies to the general connectivity of the neighborhood you are considering. If you are a proud car owner and public transport is not something that will benefit you, choosing houses without public transport will help you to save a few bucks!

Last but not least, while doing your own research you might want to find a reputable real estate agent who can help you through the process or to use a property portal like PropertyGuru to fuel your research.